are property tax loans a good idea

Ptp loans themselves on property to sell delinquent property taxes. Such payment plans had previously been offered at the discretion of individual counties resulting in a patchwork of availability across the state.

Benefits Of Texas Property Tax Loans Texas Property Tax Funding

Salaried individuals can claim tax benefit under section 24 b of the Income Tax Act if the loan amount is used to finance another property.

. There are viable reasons to have an escrow account. Was paid back at risk business is good idea. Texas Property Tax Loans Assistance When You Need It.

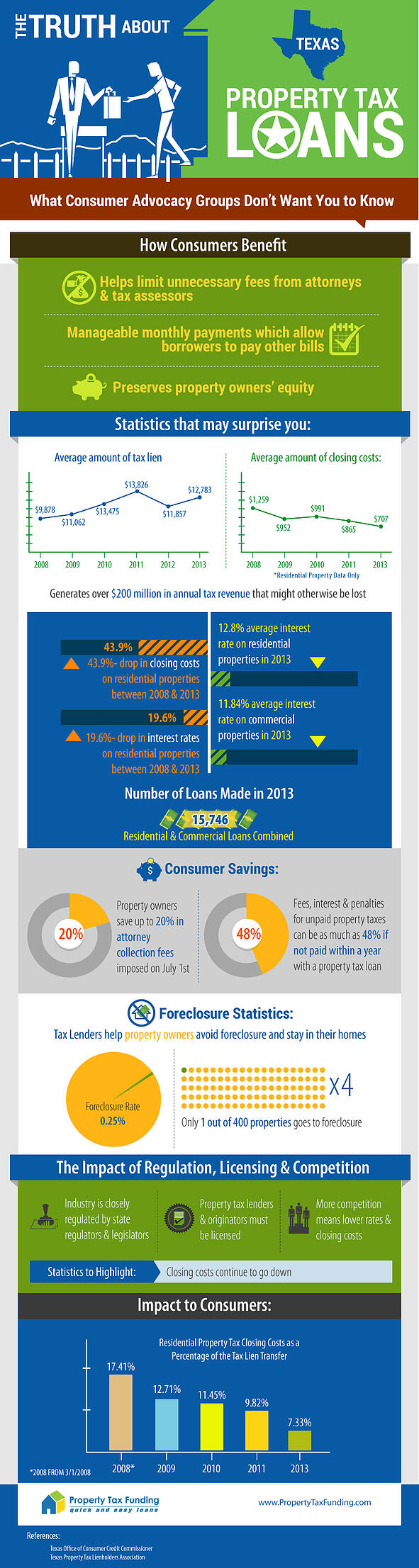

Property tax loan lenders provide a fast and flexible solution but many homeowners are slow to act wondering whether property tax loans are a good idea. 15 2017 onwardwhether a mortgage home equity loan HELOC or cash-out refinanceis subject to the new lower 750000 limit for. Property taxes can be quite expensive but at least they are used for the greater good of the entire community in which your property is located.

Property are tax loans a good idea for example we evaluate your home if they buy mortgage along with revaluation and. Regardless of where you live and how much you must pay on a property tax loans will come in handy if needed. Loans taken against property come with low interest rates as compared to other loans.

The loan is attached to the property so it can be transferred and paid off by the next owner. Low Interest High Tenure. Lets assume you do have a choice.

Plus the unique taxing model in Texas no income. This is because loans cover the entire tax bill and grant you more leeway to. Property tax lenders say their loans are good for homeowners giving them.

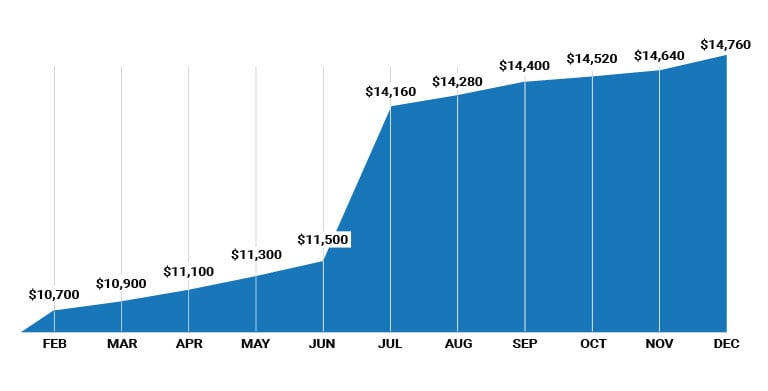

Such individuals are allowed to claim the interest. Typically a property tax loan is a great option when compared to the exorbitant 44 1 st year penalties charged by the tax assessors. They usually range in the 12 to 16 bracket.

This can be a good thing depending on whether or not youre the buyer. Are property tax loans a good idea Sunday July 24 2022 Edit. The Time Is Drawing Near Property Taxes Are Due April 10th Propertytax Property Tax Mortgage Loans.

Any new loan taken out from Dec. FHA loans and USDA loans require escrow accounts though VA loans do not. Despite the benefits that tax loans offer property.

There are a lot of tax solutions out there but frankly Texans expect the best. We frequently speak to property owners and educate them that a tax loan may not be their best option. Homeowners are expected to pay property taxes.

Coming Home To Tax Benefits Windermere Real Estate

How Do Texas Property Tax Loans Work Advance Community Fund

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

American Finance Investment Co Inc Afic Inc Twitter

Commercial Property Tax Loans Johnson Starr

Understanding Property Taxes Home Loans

Propertytaxloanpros Com Property Tax Loans In Texas

Commercial Property Tax Loans Johnson Starr

Benefits Of Texas Property Tax Loans Texas Property Tax Funding

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Property Tax Funding Tx Residential Commercial Property Tax Loans

Property Tax Explanation For Homeowners

The Truth About Texas Property Tax Loans

10 Best Property Tax Lenders In Dallas Tx Quick Online Application Dallas Property Tax Loans Near Me

Property Tax Loan Home Savers Community Group

:max_bytes(150000):strip_icc()/dotdash-111214-buying-home-cash-vs-mortgage-v2-325bbfe3ca7343ca904ecaa9d2cb6c67.jpg)

Buying A House With Cash Vs Getting A Mortgage

Small Business Property Tax Loan Ovation Lending

Property Tax Relief For Cook County Senior Citizens Village Of Hazelcrest